new capital gains tax plan

This matches the payment of taxes with the cash that is. Senator Wyden would impose a tax at the top current capital gains tax rate of 20plus the 38 net investment income tax when applicableon the annual increase in value of a taxpayers.

The presidents new budget plan calls on Congress to tax wealthy Americans unrealized capital gains.

. Powerful Easy CMMS Software For Smarter Capital Planning. Bidens proposal would take the. 51 rows Combined capital gains tax rate in New Hampshire to hit 484 under Biden plan The Center Square May 22 2021 The combined state and federal capital gains tax rate in New Hampshire would rise from the current 288 percent to 484 percent under President Bidens American Families Plan according to a new study from the Tax Foundation.

15 Mar 2022 0558 AM IST Gireesh Chandra. Ad If youre one of the millions of Americans who invested in stocks. Short-term capital gains on listed equities held for under a year is taxed at 15.

3 min read. This week President Biden introduced a new tax proposal as part of the White House fiscal year 2023 budget to raise taxes on households with net wealth over 100 million. The proposal focuses on taxing unrealized capital gains that are built up over years but are taxed only when sold for a profit.

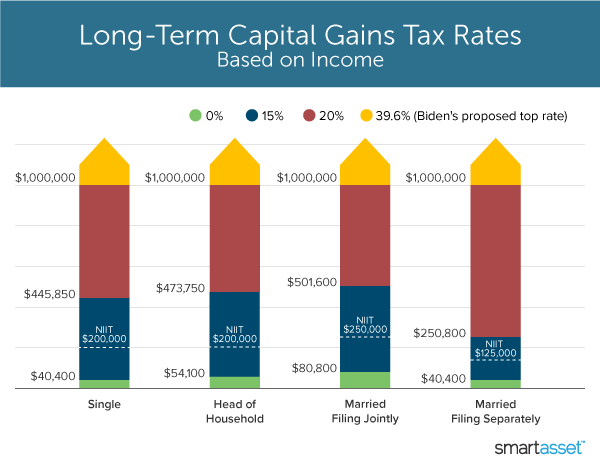

Those earning income above 1 million would have their capital gainswhether short-term gains or long-term gainstaxed at 396 as well. Currently taxes are collected on capital gains only when an asset is sold not when an asset increases in value. In 2021 the first 40400 of long-term income is.

The White House estimates that the new tax would raise about 360. The plan released by the House Ways and Means Committee Monday sets the top rate for taxing capital gains -- money earned from the sale of assets such as stocks or property -- at 25 up from 20. 2 days agoBesides increasing the corporate income tax rate to 28 and long-term capital gains and qualified dividend rates for taxpayers with taxable income of.

If your taxable income is less than 80000 some or all of your net gain may even be taxed at zero percent. And the entire 200000 in capital gains would also be subject to the 38 NIIT. Ira Stoll 3282022 350 PM Share on Facebook Share on Twitter Share on Reddit Share by.

The other main difference between long-term and short-term capital gains tax is the starting threshold. Or sold a home this past year you might be wondering how to avoid tax on capital gains. Capital Gains Tax Rates for 2021 The capital gains tax on most net gains is no more than 15 percent for most people.

Govt plans reform in capital gains tax. Voted 1 SaaS Provider. Households worth more than 100 million as.

House Democrats proposed a top 25 federal tax rate on capital gains and dividends. The proposal would require wealthy households to remit taxes on unrealized capital gains from assets such as stocks bonds or privately held companies. Therefore the tax on just her capital gains would be 59600.

Connect With a Fidelity Advisor Today. March 26 2022 229 PM PDT President Joe Biden will propose a minimum 20 tax rate that would hit both the income and unrealized capital gains of US. Ad Make Tax-Smart Investing Part of Your Tax Planning.

However the amount above 1M would be taxed at the new capital gains rate so the remaining 100000 in capital gains would be taxed at 396 39600 tax. It would apply to single taxpayers with over 400000 of income and married couples with over 450000. As of 2021 the long-term capital gains tax is typically either zero 15 or 20 percent depending upon your tax bracket.

Currently all long-term capital gains are taxed at 20. House Democrats on Monday proposed raising the top tax rate on capital gains and qualified dividends to 288 one of several tax reforms aimed at wealthy Americans to help fund a 35 trillion. Short-term capital gains taxes start at 10 percent and can exceed 37 percent for higher income brackets.

Ad Maximize Capital Budgets Investments For Stronger Communities - Get Free Custom Demo.

Double Taxation Definition Taxedu Tax Foundation

Capital Gains Tax What Is It When Do You Pay It

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Capital Gains Tax Explained Propertyinvestment Flip Investing Knowthenumbers Capital Gains Tax Capital Gain Money Isn T Everything

Made A Killing With Crypto In 2021 How To Calculate Your Tax Bill

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

The Beginner S Guide To Capital Gains Tax Infographic Transform Property Consulting Capital Gains Tax Capital Gain Investing

What S In Biden S Capital Gains Tax Plan Smartasset

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Selling Stock How Capital Gains Are Taxed The Motley Fool

The Capital Gains Tax And Inflation Econofact

Long Term Capital Gains Tax Rate How Much Tax Will I Owe

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png)

When Would I Have To Fill Out A Schedule D Irs Form

Long Term Short Term Capital Gains Tax Rate For 2013 2016 Http Capitalgainstaxrate2013 Tumblr Com Post 719 Capital Gains Tax Wealth Planning Capital Gain

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

How Might The Taxation Of Capital Gains Be Improved Tax Policy Center